Mastering the Art of Investment Strategies: Maximizing Returns and Minimizing Risks

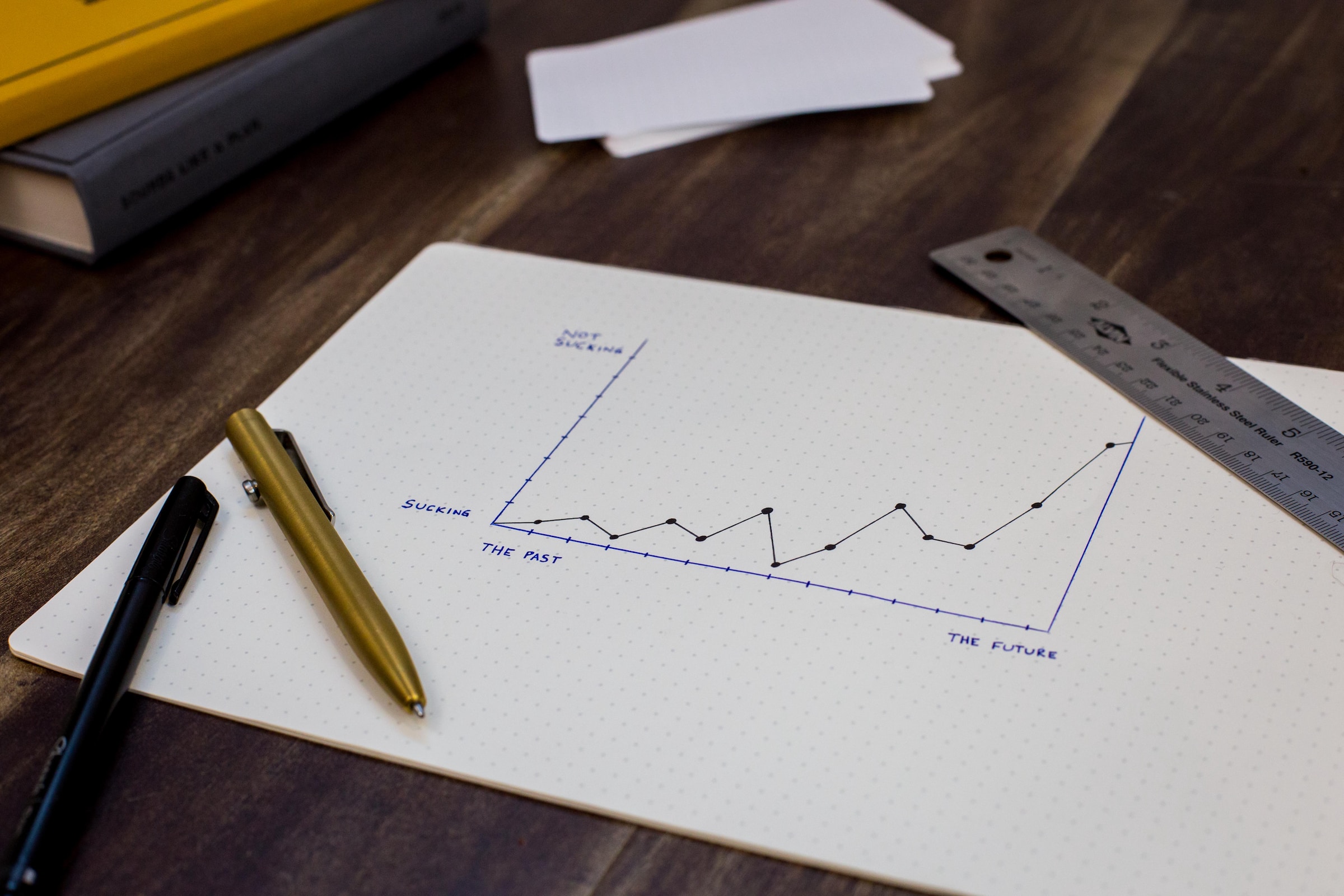

Embarking on the journey of investment is both exhilarating and daunting. To achieve your financial goals, it’s crucial to equip

IRAs (Individual Retirement Accounts) are essential financial tools for securing a comfortable retirement. With tax advantages tailored to Traditional and Roth options, individuals can contribute and invest in a tax-efficient manner. Traditional IRAs offer tax-deductible contributions and tax-deferred growth, while Roth IRAs provide tax-free withdrawals during retirement. Being aware of contribution limits, eligibility criteria, and withdrawal rules will help maximize the benefits of these accounts, ensuring a more financially secure future.

Preparing for retirement is crucial to ensure a secure and comfortable future. By utilizing retirement accounts like IRAs and carefully managing contributions, individuals can benefit from tax advantages and long-term growth. Understanding the distinctions between Traditional and Roth IRAs helps tailor investment strategies to meet specific retirement goals. With diligent planning and informed decision-making, retirement preparedness becomes the foundation for financial peace of mind in the years to come.

Embarking on the journey of investment is both exhilarating and daunting. To achieve your financial goals, it’s crucial to equip

In the ever-changing landscape of financial markets, choosing the right investment strategies is the key to achieving long-term success and

Are you ready to unleash the full potential of your investments and take charge of your financial future? In this